Our core investment philosophy here at Shojin is that everyone, regardless of the size of their portfolio, can benefit from diversifying their holdings beyond the traditional asset classes of stocks, bonds, and funds.

Alternative assets represent a chance to spread risk and to capture market-beating returns at the same time, and within the alternatives universe, it is and in all likelihood will remain real estate that ticks the most boxes for investors.

Whilst it goes without saying that economic predictions need to be treated with caution, there has been a great deal of encouraging news recently for those watching the real estate asset class and trying to predict its future trajectory.

Great expectations

Since the crisis of 2008, pension funds and other institutional investors have raised their allocation to real estate by around 20%-30%, according to PGIM Real Estate.

In large part, this was driven by the need to find enhanced yield in a fixed income environment characterised by soaring bond prices and ever sinking yields. The fact that real estate as we have already explained can offer not only strong yields but also capital preservation and appreciation further boosted the asset class's appeal.

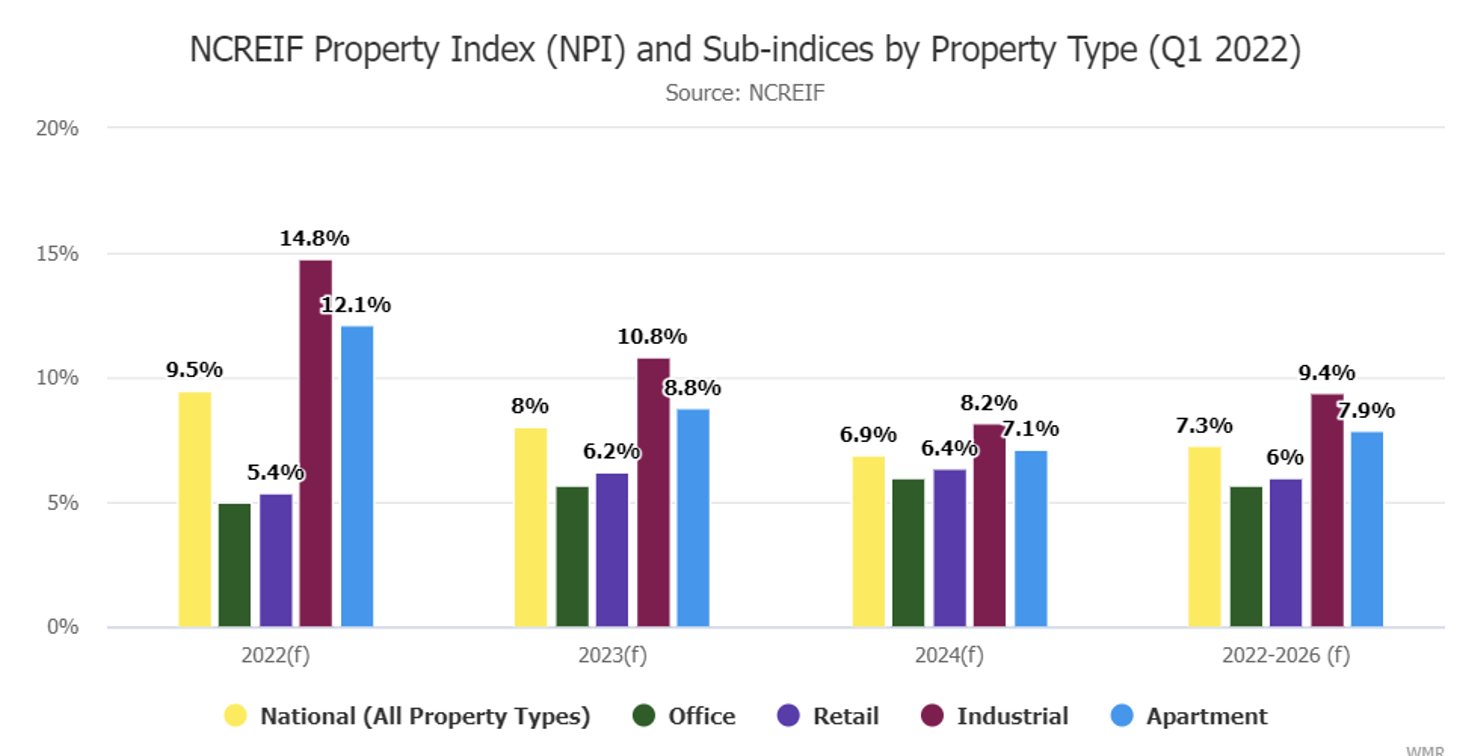

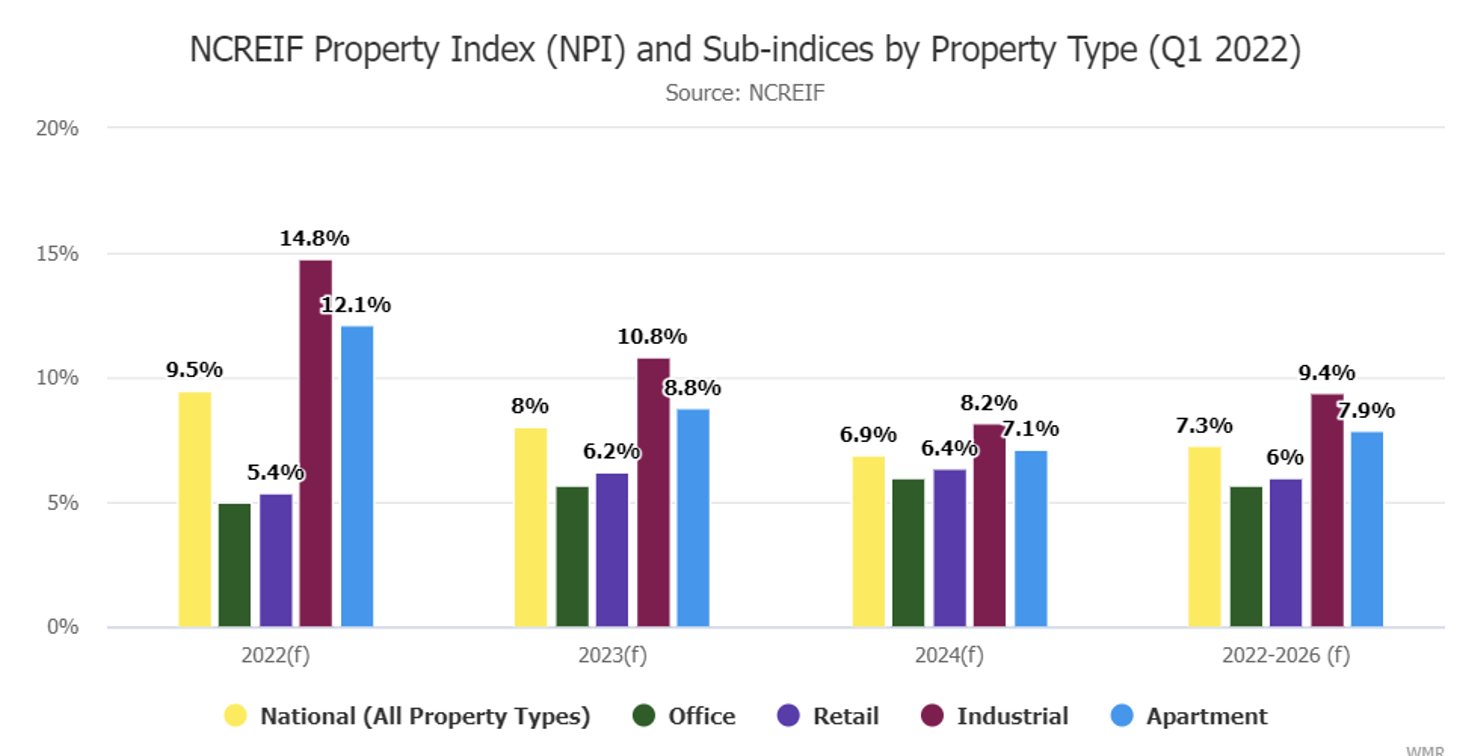

Looking ahead, the National Council of Real Estate Investment Fiduciaries (NCREIF), a well-respected source of data on the US real estate market, have recently published the results of their benchmark survey of asset managers.

As the chart below shows, the pension funds surveyed remain overwhelmingly bullish on real estate assets, with expected total returns anticipated to be healthy in all sub-categories out until at least 2026.

A similar overall picture is expected in the UK, with pension funds here likewise seeing property investment as a vital tool to navigate stock market volatility whilst achieving better yields than the safest parts of the bond market can offer.

In general, research conducted by pension funds tends to be high quality and reliable, based on both the size of the research teams such funds usually have at their disposal, as well as the fact that pension funds are normally prohibited from excessive risk-taking and therefore need to be much more confident their forecasts are reliable than more speculative financial institutions.

Institutional investors are raising their allocation to real estate

A noticeable trend has been the increasing exposure to property investments sought by some of the world’s largest fund managers.

For example, the British Colombia Investment Management Corporation has substantially increased its allocation to alternative assets over the past few years, a process that has seen alternatives rise from 20% in 2015 to circa 45% today. The fund’s allocation target over the next three to five years is to raise this even further to approximately 55%, and this pattern is far from unique.

Of the 45% currently in alternatives, real estate makes up the largest single asset class at around 20%, followed by private equity and infrastructure some way behind.

This story, whereby the world’s largest institutions are first to the punch and capture the lion’s share of the gains to be had from the fact that real estate is uniquely well-positioned to succeed in the current macroeconomic climate, has been true at more or less every other significant change in market regimes.

The difference is that today, due to advances in fractional ownership technology lowering the barriers to entry into real estate investment, a vastly wider and more diverse group of investors can participate in this lucrative sector.

There has never been a better time to diversify into real estate

Real estate assets can add a huge amount to an investment portfolio currently centred on traditional assets.

Not only is diversification across asset classes a good idea from the point of view of hedging against downside risk, diversification into property can generate inflation-beating rental income, as well as offering the chance of capital appreciation in excess of that offered by indexes tracking the main public markets.

Real estate assets can therefore add stability to a growth-oriented and riskier portfolio, but could also add growth potential and the chance of capital appreciation to a more risk-averse fixed income portfolio.

As 2022 continues to provide economic surprises and the medium-term outlook for the developed markets remains uncertain, real estate assets today look as appealing as they ever have. Hence it is unsurprising to see major institutional investors allocating more and more of their capital toward property investments.

As we have always argued here at Shojin, the days when this path was closed to all but the largest investors are gone for good.

Whatever your risk tolerance – and as is often remarked, we all feel like we have a high tolerance for risk until we see the financial consequences of genuinely severe downturns in the markets – real estate can add something to your portfolio.

Whilst returns can never be predicted with any degree of certainty, what we are certain about is that the unique combination of characteristics that have always served to make real estate such an important compliment to traditional investments are just as valid today as they were in the past. If anything, the high inflationary context of today simply makes real estate an even more appropriate addition to the average individual portfolio.