Previously we’ve posted some of our thoughts on what is wrong with today’s asset management industry. In short, we believe the fees charged by most wealth management firms have eroded the returns investors actually receive down to levels not far above – and often even lower – than can be had from simply parking your money in an index-tracking mutual fund.

In today’s high inflation environment, savers deserve better, and this is what we are passionate about here at Shojin.

Part of the solution to gaining superior returns at lower fees is the use of technology to streamline investment processes and cut out unnecessary intermediaries. Another aspect, however, is the type of assets we can make available to individual investors.

This article will explore the rising importance of so-called ‘alternative investments’, and why they represent a chance for private investors to get involved in highly profitable long-term investments previously out of reach for all but the largest institutional investors and ultra-wealthy.

What are alternative investments?

We are all familiar with the traditional asset classes including stocks, bonds, and cash. These can be thought of as ‘staples’ of any financial plan an individual might have for themselves and their family.

However, whilst for most individuals the menu of options for saving and investment choices ends here with these three familiar possibilities, institutional investors like pension funds and some high-net-worth individuals have always had an additional set of options available to them.

These other options are collectively known as alternative investments, primary examples being real estate, private equity, hedge funds, infrastructure, and commodities like gold.

The only thing that unites this disparate group is that these investment opportunities are unlisted, in the sense that they don’t appear directly on the stock market, and that they typically require much larger capital outlays from the investor.

What makes alternatives so appealing?

There are many, many points to raise here, but in this introductory article we’ll stick to three.

Alternative investments are so important because they can enhance returns above what index-tracking funds can achieve; they diversify a portfolio and so reduce risk; and they often generate flows of income for their owners.

To dig into each of the claims a little deeper let’s focus on real estate, the alternative investment asset category we specialise in here at Shojin.

Enhanced returns

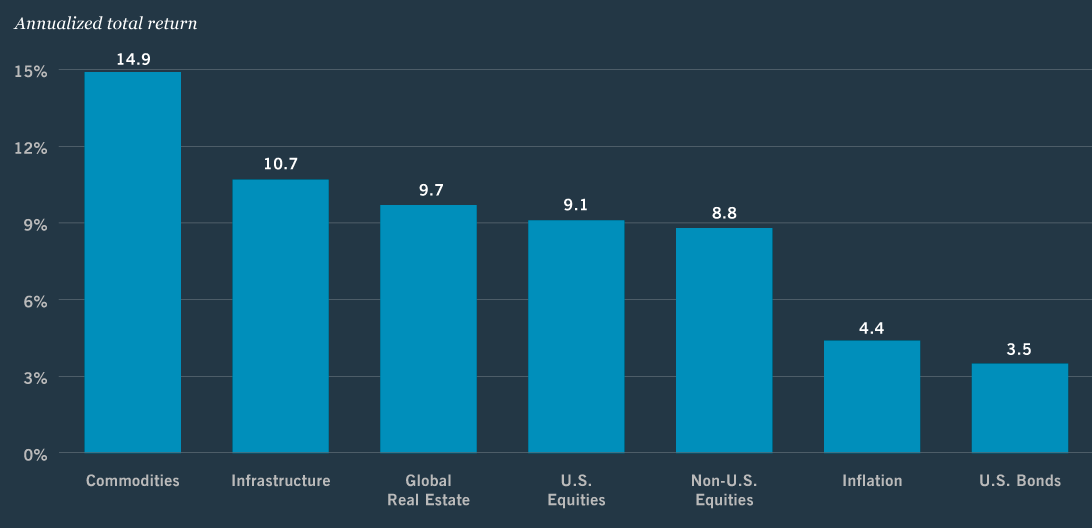

The graph below shows the annualised total returns of global real estate compared to other asset classes.

Source - Nuveen.com

There is something of a false debate in terms of real estate versus stocks on this issue. It’s not a case of one instead of the other; a well-balanced portfolio should contain both in a blend determined by the investor based on when they expect to withdraw their capital.

Real estate can generate returns in excess of the average given by the stock market because property investments have the flexible ability to benefit from growth in any sector of the economy.

For example, a rise in biotech and life sciences start-up activity will certainly yield some successful companies, as well as many more which will ultimately prove unsuccessful, but the value of the science park where they all need to rent or outright purchase their office and lab space is a more certain proposition.

Diversification

To continue with the hypothetical example above, the post-Covid rush of equity investors into pharmaceuticals companies large and small will generate increased volatility in these share prices. For those investors willing to spend their free time monitoring the market and trying to time entries and exits in and out of various stocks, this might be good news.

For those who prefer to invest their cash once and watch it rise over time, diversity of investments has always been essential. By spreading your capital across a range of asset classes, you are much better protected against dramatic falls in value overnight and you are able to enjoy exposure to growth potential in multiple asset classes simultaneously.

Real estate has always been the classic method of diversifying a portfolio for the biggest investors because property valuations don’t necessarily decline when the overall market turns bearish.

Passive income

Perhaps the strongest argument for the inclusion of real estate in any portfolio is its unrivalled ability to produce passive income for its owner.

Well-researched real estate investments can provide a stable yield to their owners which should rise ahead of inflation over time. The long-term contractual nature of these income streams makes them especially attractive from an investor's point of view.

Given the ongoing decline in the corporate and government bond market's ability to provide sufficient income to investors through coupon payments, the income yielding nature of real estate further reinforces its importance as an asset class today.

Why is 2022 the right time to gain exposure to alternatives?

One of the ironies of the term ‘alternative ‘investment’ is that it suggests the group of asset classes included are in some very rare or unusual. Nothing could be further from the truth!

Alternative investments have always been a key part of the investment strategies used by the big players, whether we are referring to hedge funds, pension funds, or high-net-worth individuals.

According to the Chartered Alternative Investment Analyst Association, alternative investments have already achieved promotion from the periphery of the global investment landscape to the mainstream. In just over a decade, alternatives had grown from 6% to 12% of the global investment market by 2018, and they are predicted to reach between 18-24% by 2025.

As mentioned in our previous article, it is only very recently that technological developments in the field of peer-to-peer lending have brought alternative investments like real estate within reach of ordinary investors.

There has never been a better time to start exploring the potential of alternative assets and what they can bring to your portfolio.

Why not have a look at the real estate investment opportunities we offer at Shojin, to start.