“It is not hard to make money in the market. What is hard to avoid is the alluring temptation to throw your money away on short, get-rich-quick speculative binges. It is an obvious lesson, but one frequently ignored.” Burton Malkiel, A Random Walk Down Wall Street

In his timeless classic A Random Walk Down Wall Street, economist and investor Burton Malkiel put forward the most forthright and compelling statement of the ‘random walk’ theory of financial markets. The relevance of these ideas has never been greater than today, and this article outlines how Malkiel’s theory helps to explain what is so wrong with the asset management industry today.

Essentially, the theory claims that short-term movements in asset prices are unknowable and unpredictable, and therefore it is long-term patterns alone that investors should focus on. The term ‘random walk’ originates in mathematics and is used to describe any process which evolves over time but in a manner completely lacking in any regularity.

Random walk theorists like Malkiel argue that the movements of any single asset price from minute-to-minute form a credible example of a random walk, and investors need to adjust their approach accordingly.

What does this mean in practice?

Two conclusions follow from Malkiel’s argument.

1. Investors should focus primarily on assets that have some objective or fundamental virtues that can ensure their value is likely to rise over time, even if not on a day-to-day, hour-by-hour basis. This means either that they yield a good income to their owner, or that they have a strong possibility of gaining in value over time.

2. Secondly, as Malkiel himself attests to in the above quotation, savvy investors should treat with scepticism any promise to achieve record-breaking returns in the near term. This is not to say that someone can’t ‘make a killing’ overnight from time to time, simply that anyone who claims to be able to do this consistently on behalf of their clients may well be too good to be true.

The problem with asset management today

This brings us to the problem with financial services in general, and more specifically with the asset management industry today. With a record £9.4 trillion in assets being managed by UK members of the Investment Association, the past decade has been highly successful for this section of the financial services ecosystem.

However, whilst assets under management (AUM) have skyrocketed, investor returns haven’t always kept up.

This is due to multiple factors, but of particular significance are the layers of fees charged by investment managers to their clients which consistently erode final returns, as well as the fact that evermore managers chasing after the same set of profitable investments has further driven up costs and driven down returns.

This is the fundamental problem with paying someone else to manage your money for you – their interests and prosperity owe much more to their ability to charge you fees for the privilege of you accessing their expertise than it does to them using said expertise to make money for you. As the old joke goes, you get rich by selling financial advice, not by following it.

Is there a better way?

The short answer, in our opinion, is yes there is.

This is because recent advances in technology are now starting to allow a much more direct relationship between those with surplus cash in search of healthy returns and companies that can offer profitable investment opportunities.

The fact that this relationship can now be more direct reduces the need for asset managers to act as ‘middlemen’ intermediating between savers and borrowers. This has several notable benefits, most importantly that by reducing the costs in both fees and time involved in getting your cash into productive investments, returns can be raised without a significant increase in the risk being born.

In fact, for the past two years in a row the returns to so-called ‘peer-to-peer’ or direct lending investment accounts have been north of 9%.

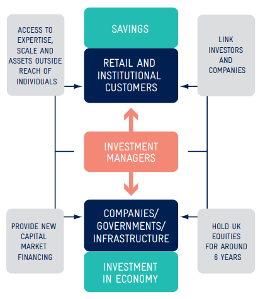

The infographic below sourced from the Investment Association Annual Survey, September 2021 illustrates the traditional relationship between saving and investment.

Investment managers have been the crucial linking agents of the economy by bringing together savers, be they institutions or individuals, with companies and entrepreneurs who need capital to expand their operations.

Investment managers have been the crucial linking agents of the economy by bringing together savers, be they institutions or individuals, with companies and entrepreneurs who need capital to expand their operations.

Without the middlemen, such transactions would in the past have been too tiresome or complicated to enact without the involvement of investment managers

However, today's technology is now enabling disintermediation, which means it is possible and in fact desirable for savers to interact directly with borrowers.

This not only gives much more control to savers over how their hard-earned cash is put to work for them, but also gives them access to the same profitable opportunities the investment managers were opening up for them at significantly lower costs. This ability to combine highly profitable investments with much reduced costs is part of what makes the technological advances of recent years so exciting, and something we believe all retail investors should know about.

How to take advantage of these tech breakthroughs?

This is something we’ll address in much more depth in upcoming articles, but for now it’s worth mentioning that the UK-based investors are actually uniquely well placed to enjoy the benefits of these developments.

The emergence of a host of enterprising financial technology, or fintech, companies in and around the City has injected a fresh dose of competition into the sector, and this will ultimately work in the interests of consumers.

Secondly, the quality of the UK’s financial regulation means that trust in financial innovation is high, and new ideas that can improve returns for savers are given the green light once they have proven to be safe and stable.

In short, the asset management industry may well be broken, but the tech and the new ideas needed to fix it are already here!

The world of investment is changing

Platforms like Shojin enable investors to disintermediate traditional asset managers and access deals directly to benefit from enhanced returns. This is the democratisation of investments. There is a golden period of opportunity in real estate development right now, and it is getting the attention of smart investors globally. Read more about fractional real estate investing >