City AM recently reported that a staggering 36,000 new millionaires have been created as a result of the post-pandemic property boom, taking the UK population’s number of millionaires in dollar terms above 600,000.

Arguably no one understands the need to diversify better than the average high-net-worth individual.

Although the term high-net-worth can mean different things in different contexts, for the purposes of this article we will use the most commonly accepted definition. An individual is classified as being high-net-worth if they have access to at least $1 million in liquid financial assets.

We have already discussed the importance of diversification from several different perspectives, but today we will examine exactly why those with over $1 million to invest remain so deeply attached to real estate as an asset class.

The first rule of investing: don’t lose money!

This might sound blindingly obvious, but it needs to be unpacked in a little more detail.

Say you invest in some financial asset valued at £1,000. Soon, due to some external factor changing, the value of this asset falls sharply to around £500. As we have seen in previous articles, such dramatic falls in the stock market are not only possible but have in fact occurred with reasonable regularity over the past twenty years. From the bursting of the Dot.com bubble in the early 2000s to today’s market turbulence, the only certainty offered by equities is that periodic crises are inevitable.

In the example above, where the value fell from £1,000 to £500, this equated to a 50% decline in your capital. What sort of an increase would you need to see in the other direction to get you back to where you started? Would 50% do?

No! To return from £500 to £1,000, you need to see a 100% increase, because this is now measured against the lower starting value. So, put simply, to recover from a 50% decline, you need a subsequent 100% increase in value.

Even more telling is the fact that even if you earnt an impressive 10% per annum on the above hypothetical investment, after the 50% loss of capital value you would need a full 10 years of 10% returns to recover the initial loss. And then at the end of this arduous 10-year process you have only arrived back to where you started; you still haven’t increased your net worth yet.

As such, it is easy to see why long-term successful investors like Warren Buffet have always subscribed to the famous first rule of investing – don’t lose money.

Capital preservation plus compounding equals long-term success

Essentially, whilst high-net-worth individuals are wealthy by both local and global standards, they are unlikely to be wealthy enough to shrug off a large or sudden loss of capital. They are, at the risk of generalising a bit, also unlikely to be the sort of person who is happy to ‘gamble’ with their money, and are likely to prefer sensible, well thought through investment schemes over get-rich-quick speculation.

As such, high-net-worth individuals are always diversified across their holdings, with portions of their capital allocated between stocks, bonds, and funds on the one hand, and alternatives, especially real estate, on the other.

Real estate can offer such a large amount to such diversified portfolios because it fully satisfies the first rule of investing – over the long-term it is incredibly difficult to lose money on real estate assets – but as well as preserving capital, property investment also offers both rental income and the chance for capital appreciation over time.

If preservation of capital alone is the main objective, then a laddered portfolio of high-quality US and other developed market government debt would be a viable option.

However, the income yielded by such investments would be very low in relative terms and would therefore not make it attractive to anyone either looking to draw an income from the assets today or to simply earn interest-on-interest and reinvest the income as it is earnt. Plus, the possibility for capital appreciation in a purely bond-based portfolio is negligible, unless you are willing to position yourself at the far end of the yield curve and place bets on the direction of future interest rates.

Real estate as the foundation of a well-diversified portfolio

Real estate, on the other hand, offers not only excellent capital preservation characteristics as some corners of the bond market do, but also offers the chance for capital gains as well.

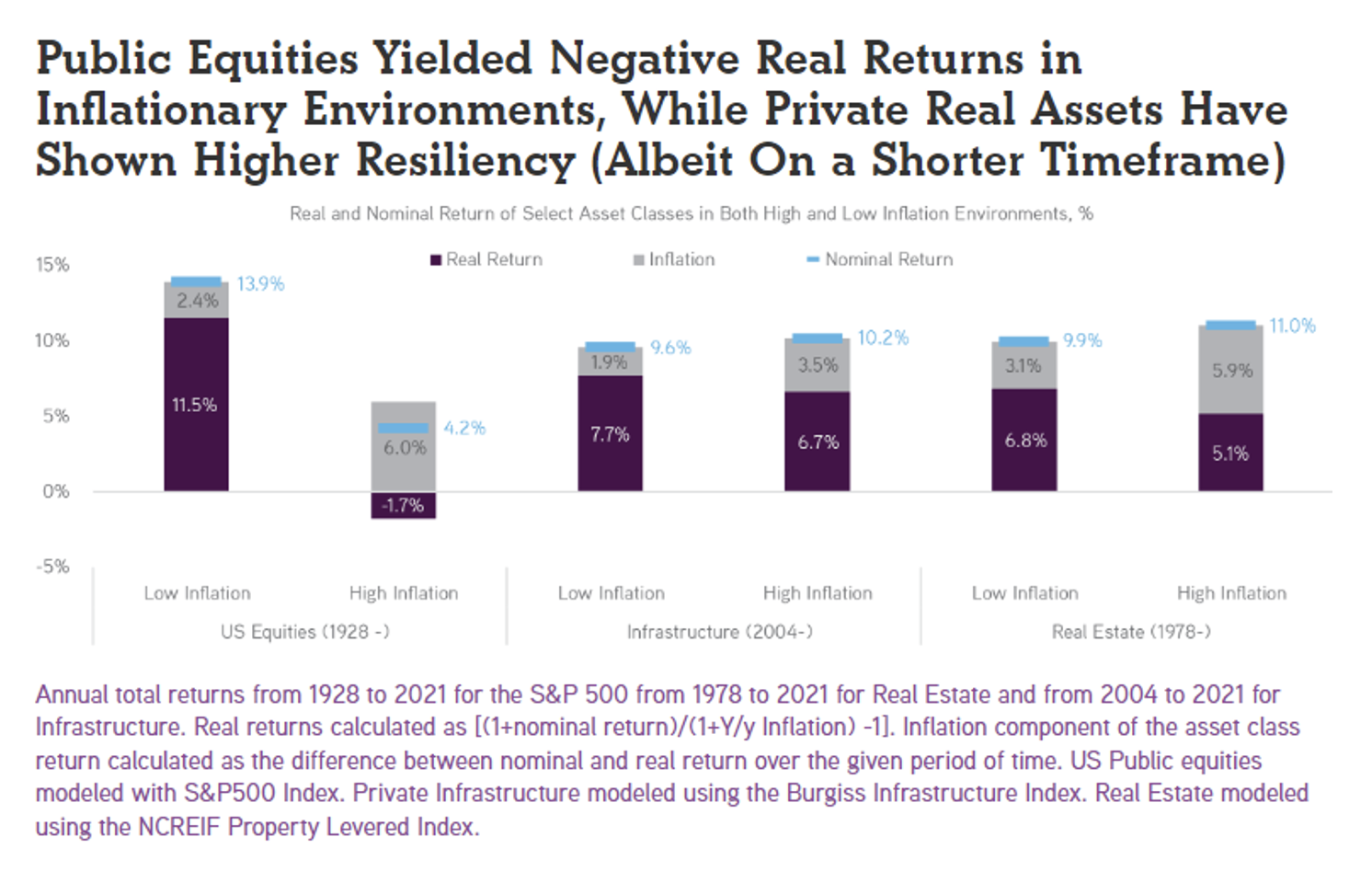

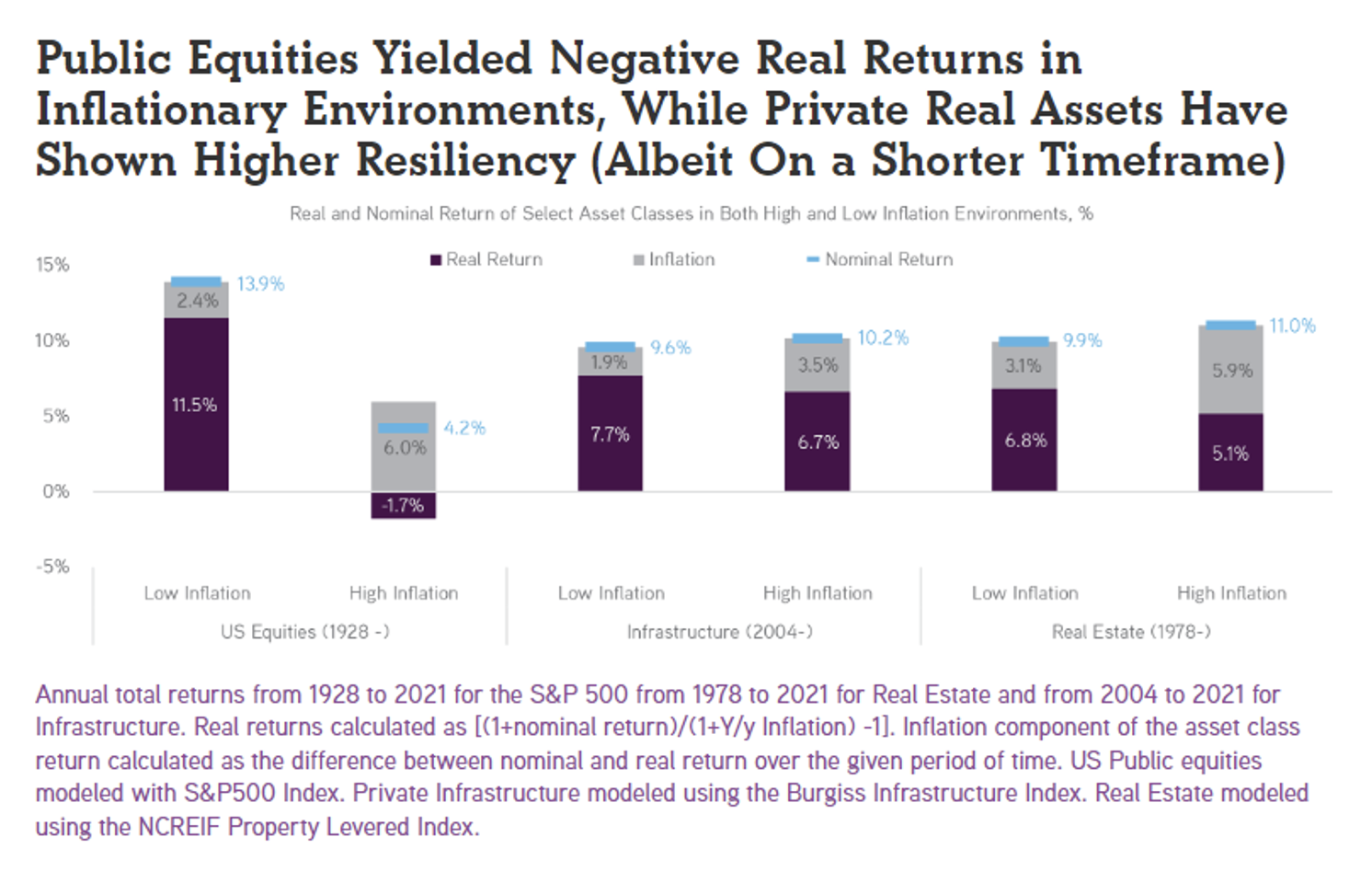

As can be seen in the graphic below sourced from a report by KKR, real estate has an enviable record in terms of producing real returns, even in high inflationary environments.

Whilst equities can struggle as soon as the economy runs into headwinds, real estate and the related asset class of infrastructure both have held up well historically through periods of high inflation. This is just another reason why the wealthy have always preferred to keep a sizeable portion of their assets in the real estate sector.

Whilst equities can struggle as soon as the economy runs into headwinds, real estate and the related asset class of infrastructure both have held up well historically through periods of high inflation. This is just another reason why the wealthy have always preferred to keep a sizeable portion of their assets in the real estate sector.

Whilst equities can struggle as soon as the economy runs into headwinds, real estate and the related asset class of infrastructure both have held up well historically through periods of high inflation. This is just another reason why the wealthy have always preferred to keep a sizeable portion of their assets in the real estate sector.

Whilst equities can struggle as soon as the economy runs into headwinds, real estate and the related asset class of infrastructure both have held up well historically through periods of high inflation. This is just another reason why the wealthy have always preferred to keep a sizeable portion of their assets in the real estate sector. Here at Shojin we believe the strengths of real estate as an asset class can and should be enjoyed by everyone, regardless of their net worth. If you are in any way unsatisfied with the performance of your portfolio of traditional assets, it is highly likely that adding in a real estate component could improve the performance of your portfolio from either a capital preservation, capital appreciation, or an income yielding perspective.