While many investors understand the value of real assets such as property, finding the right way to integrate this asset class into a diversified portfolio isn’t always straightforward. In this blog post, we share our knowledge of the mid-market property sector, the ratios and terms investors need to understand when evaluating opportunities, and the advantages of investing on a fractional basis.

Mid-market opportunities

Property development and investment encompasses a broad and diverse range of projects and opportunities; from individual units suitable for buy-to-let management to multi-billion infrastructure schemes. Modest projects (whether construction, conversion or renovation) are often funded by friends and family or through a bank loan. On the opposite end of the scale, larger projects also benefit from well-established lines of funding, including financial institutions, investments banks and private equity firms. It is the mid-size, mid-market projects that are underserviced and find funding more difficult.

There is reduced competition for lenders willing to back mid-market developers and, consequently, great returns on offer for those who do provide funding. Mid-size projects have advantages for developers too; projects can be diverse (from residential housing to student accommodation and private rental schemes), and they can be adapted to changing market conditions due to their manageable size.

The capital stack

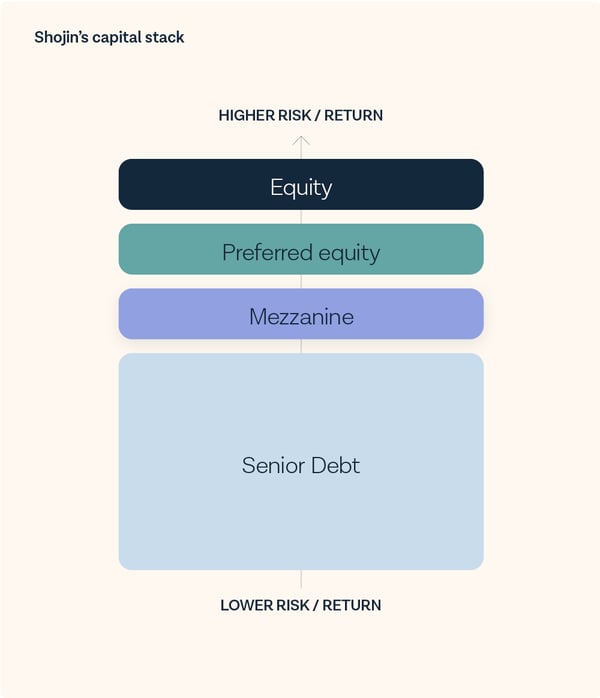

The capital stack is a crucial concept to understand in real estate investment, as it encapsulates the layers of capital and funding involved in a project. Once properly modelled and visualised, the capital stack can show us the priority of repayment for investors, and the security available.

From senior debt with lower risk and returns to equity with the highest risk and potential for substantial returns, each layer has specific characteristics. Mezzanine and preferred equity fill the gaps between senior and equity and offer varying levels of risk and return. Understanding the composition of the capital stack is essential for tailoring investment strategies to individual risk appetites and desired returns.

The ratios and risk

For investors, understanding and analysing ratios such as loan-to-value (LTV), loan-to-cost (LTC), and loan to gross development value (LTGDV) provides valuable insights into the risk associated with a real estate project.

- Loan-to-value (LTV) is a crucial metric in real estate and mortgage transactions, representing the ratio of the loan amount to the appraised value of the property. Expressed as a percentage, LTV is a key determinant of risk in such investments. A lower LTV implies a smaller loan relative to the property's value, signalling higher equity and lower risk for lenders.

For investors, maintaining a conservative LTV offers various advantages, including protection against negative equity during market downturns and a smoother exit if developers are seeking a refinance. While developers may desire a low LTV to retain more profits, leveraging properties with higher LTV can boost returns, especially if borrowing costs are lower than the value created in the project. The process of determining property value, especially through independent surveys like Red Book valuations, becomes essential for assessing LTV accurately.

- Loan-to-cost (LTC) represents the ratio of the loan amount to the total project cost, which includes expenses like land acquisition, construction, and associated costs. This metric helps investors gauge the level of commitment or "skin in the game" from developers, as it reflects the capital they have invested themselves.

A lower LTC indicates a smaller loan relative to the overall project cost, showcasing a higher equity investment by the developer and signalling a lower risk for investors. Maintaining a conservative LTC offers real estate developers several advantages, including reduced financial risk by relying more on equity, which enhances the project's resilience to unforeseen expenses or market fluctuations. Additionally, a lower LTC may lead to more favourable loan terms, contributing to the project's overall feasibility and profitability. Cash and equity contributions are both considered when calculating LTC, providing a comprehensive view of the developer's investment.

Developers might opt for a higher LTC for reasons similar to those for a high LTV, and the concept of sweat equity, where developers contribute effort and expertise, can mitigate investor concerns associated with higher LTC. Overall, LTC is a valuable tool for assessing the financial structure and risk profile of a real estate development project. - Loan-to-gross-development-value (LTGDV) is a financial metric that assesses the market value of the completed building in relation to the loan amount. It is calculated by dividing the loan amount by the gross-development-value (GDV), which represents the market value of the finished project.

The industry typically targets a profit on cost of around 20% based on the basic cost, with a standard senior loan-to-cost ratio of 65%. However, these figures can vary based on external factors, such as the property's location, with a lower GDV considered in desirable areas. The profit on cost calculation only considers the senior loan, excluding mezzanine or equity loans. As a project progresses, developers receive drawdowns, meaning loans are disbursed gradually as work is completed. This phased approach reduces the risk associated with the project over time, with finished products considered less risky. The LTGDV ratio provides insight into the financial viability and risk profile of a development project, with lower ratios suggesting a safer investment relative to the market value of the completed building.

For other terms used in property investing, please visit our glossary page.

Technology's role in enhancing efficiency

As in other asset classes, the use of technology in real estate investing will continue to enhance efficiency and accessibility. Through digitalisation and fractionalisation, platforms can open up the capital stack to investors through tranching, allowing for tailored risk exposure and greater flexibility. With diversification a key principle for investors, the ability to spread capital across multiple projects offers a more-balanced portfolio, enhanced returns and mitigation against individual project risk.

Summary

While it has distinct terminology and nuances, the universal concepts of diversification and risk tolerance apply to property investing as much as any other asset class. By capitalising on market inefficiencies, embracing technological advancements, and understanding concepts such as the capital stack and risk ratios, investors can add property development to their portfolio with confidence.

View Shojin’s latest real estate investment opportunities