In the UK, we have always loved buy-to-let investing. It’s an investment in bricks and mortar, you can see it, touch it, feel it and even live in it. How many other investments can boast that!? What’s more, every budding property tycoon has read that property values increase, on average, at 10% per year over the long term, so it’s a sure winner, right?

Perhaps, once upon a time, BTL investments made a lot of sense. A lot of people made a lot of money in the BTL market. However, times have changed. Those things that once drove the immense growth in the BTL market no longer support it.

Over the past 30 years almost anyone could buy a property and rent it out as long as they had the deposit funds. As a result, many saw an opportunity to continue where Rupert Rigsby left off and used property as a cash cow, completely neglecting the tenant in the process. Quality standards were poor, which is a travesty in this age of B&Q and IKEA. Some landlords also thought nothing of squeezing more people into a property to maximise rent, creating fire hazards in the process.

The government has rightly cracked down on poor practices. In many countries around the world, renting is the norm and rental blocks are owned and managed by institutional, professional landlords. The quality, as a result, is much higher than in the UK. With the growing number of renters in the UK, the government has to tackle this issue.

So the government is killing off the traditional buy to let market through higher taxes and increasing regulation. However, as a steady business, property still makes sense. The rental market in the UK is growing and still presents a fantastic investment if done correctly.

Some of you may have come across REITs (Real Estate Investment Trusts). A REIT is effectively an exchange-listed property portfolio that must pay out 95% of the income it derives to the end investors. This is a tax-efficient way to invest in property because the REIT itself does not pay any tax, which is in turn paid by the investor. It is a great model, but unfortunately has two drawbacks. The first is that size is important because of the costs involved. It has to be listed on an exchange and any fund under £50m is just not really worth setting up. Secondly however, and more importantly, in the UK only REITs containing commercial property were allowed until a few years ago when the government allowed residential REITs to be created. Not many have established residential REITs though because, unlike commercial property, there are few individual properties that can be purchased for several million pounds at a time. Most UK residential property stock is built for selling to individual end-buyers so it is very time consuming and costly to fill a residential REIT portfolio, and even harder to manage. Consequently residential REITs have not really taken off.

That’s where crowdfunding comes in. With the use of crowdfunding technology, many investors can now be brought together to invest in a small portfolio of residential property for rental purposes. They can then share the income and capital growth. The crowdfunding company typically manages the property and since they are likely to have many, many properties, they can do so at a professional level with economies of scale. The beauty of this type of investment is that it is familiar to investors, but at the same time completely hands-off.

However, there is still a problem. The tax position of Investors often has a big part to play in whether BTL is a sensible investment. A higher rate taxpayer, for example, may not care for the income due to the higher taxation, hoping instead to make a decent capital gain. While a lower rate taxpayer may prefer to receive the income, to be able to fully utilize the interest deduction and also live off the income. Why not, therefore, break this investment up into two pieces – one for those that want regular income and another for those that prefer capital gains.

Shojin Property Partners have created a product that does just that.

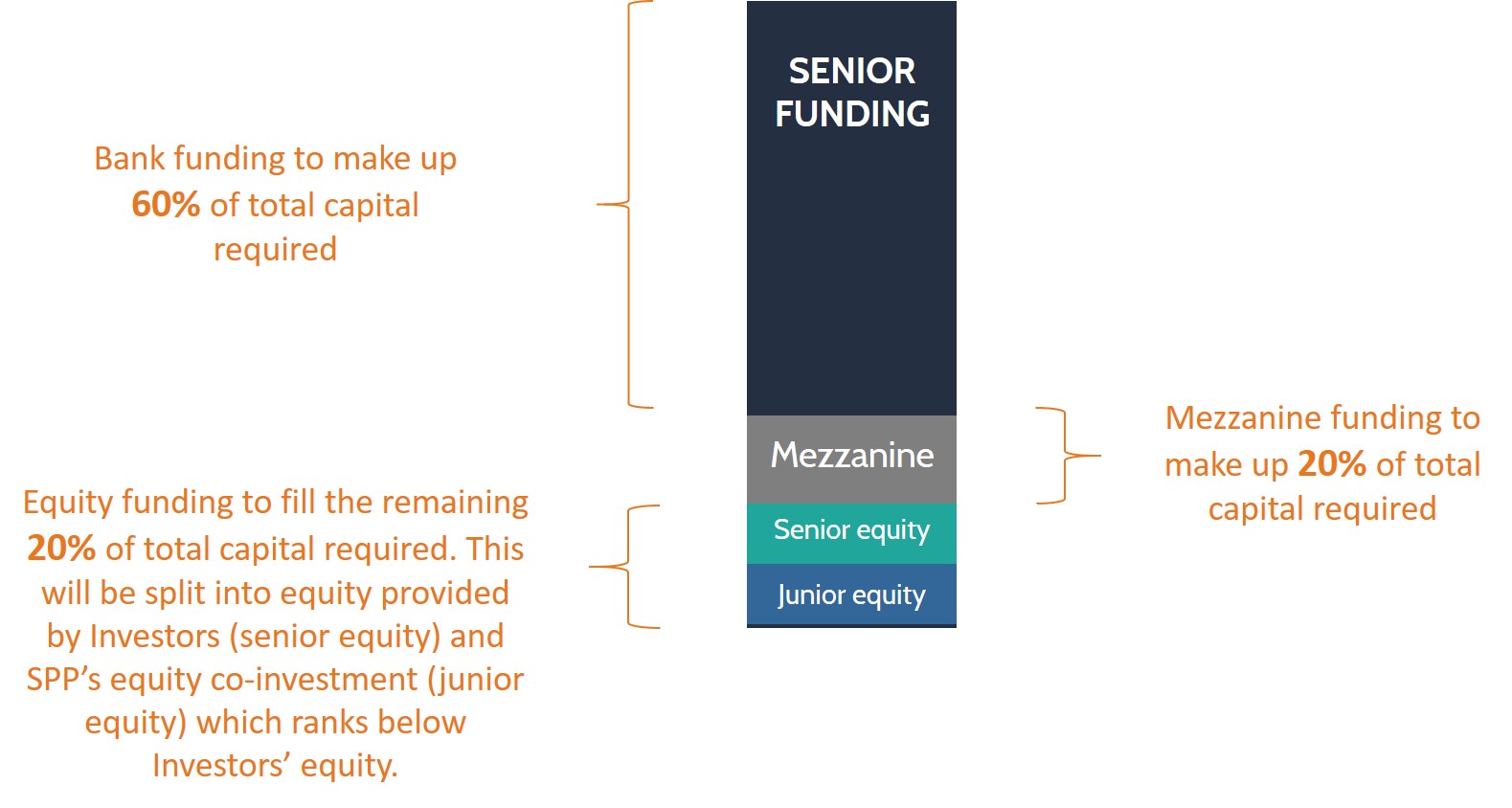

Rather than the traditional structure with a bank and an equity investor, we have placed a mezzanine tranche in the middle. Most people in the UK do not utilise their capital gains tax allowance, so our structure enables higher rate tax payers to take a leveraged position in equity, while giving up the income. The mezzanine investor meanwhile benefits from a fixed return, regular income and higher security.

So, we have a senior lender providing 60% of the funding on a fixed interest basis; we have a mezzanine lender that can earn a fixed rate of 5% per annum with quarterly interest payments and a second charge security that ranks ahead of the equity investor; the equity investor meanwhile keeps all the capital growth on the property. The equity investor may then be able to sell some shares each year on our upcoming secondary trading platform, to benefit from the circa £11,000 capital gains tax allowance, to earn his/her return tax-free.