The importance of the alternatives sector, and real estate in particular, is something we feel very strongly about here at Shojin. Not only do alternatives like property offer investors the chance of market-beating returns, but they also provide an unrivalled ability to outrun inflation, as well as serving to diversify and spread risk.

Today, the universe of alternative investments is larger and more diverse than ever before, and thanks to the efforts of companies like Shojin, opportunities in this space are now open to mainstream investors for the first time.

How does real estate compare to other alternatives?

Real estate is, and will in all likelihood remain, the undisputed king of the alternative investment sector.

This is because the nature of the asset class itself – ownership of actual land and buildings – is so ubiquitous and is understood in every economy to be one of the most reliable methods of preserving and building wealth.

This has made property the world’s most significant method of storing wealth over time, and means that today global real estate is more valuable than the entirety of global equities and fixed income securities combined.

Indeed, the wealth stored in real estate is so vast that it can be hard to comprehend. Today, the value of global real estate towers well above the size of global GDP; by comparison, the value of all the gold that has ever been mined comes in at just around 4% of global GDP according to research from Savills.

So, real estate represents a truly colossal asset class when viewed on a global scale, although we may not necessarily be familiar with thinking about real estate in this way and in these terms, given that our main experience of the asset class is in terms of our primary residence.

Real estate investment strategy in action

Now that we’ve established the size and inherent potential of the asset class, the natural follow-up question is how do investors actually start to think about where, when, and what type of real estate assets they would like to gain exposure to?

This leads us to a second great merit of the asset class; not only does real estate allow diversification and risk-spreading in comparison to traditional investments like equities and bonds, but the sheer size and variety of the asset class itself also allows abundant opportunities for diversification within the overall sector of global real estate.

This is where it becomes possible to express different investment philosophies and views about the future path of the economy by selecting different types of property to invest in.

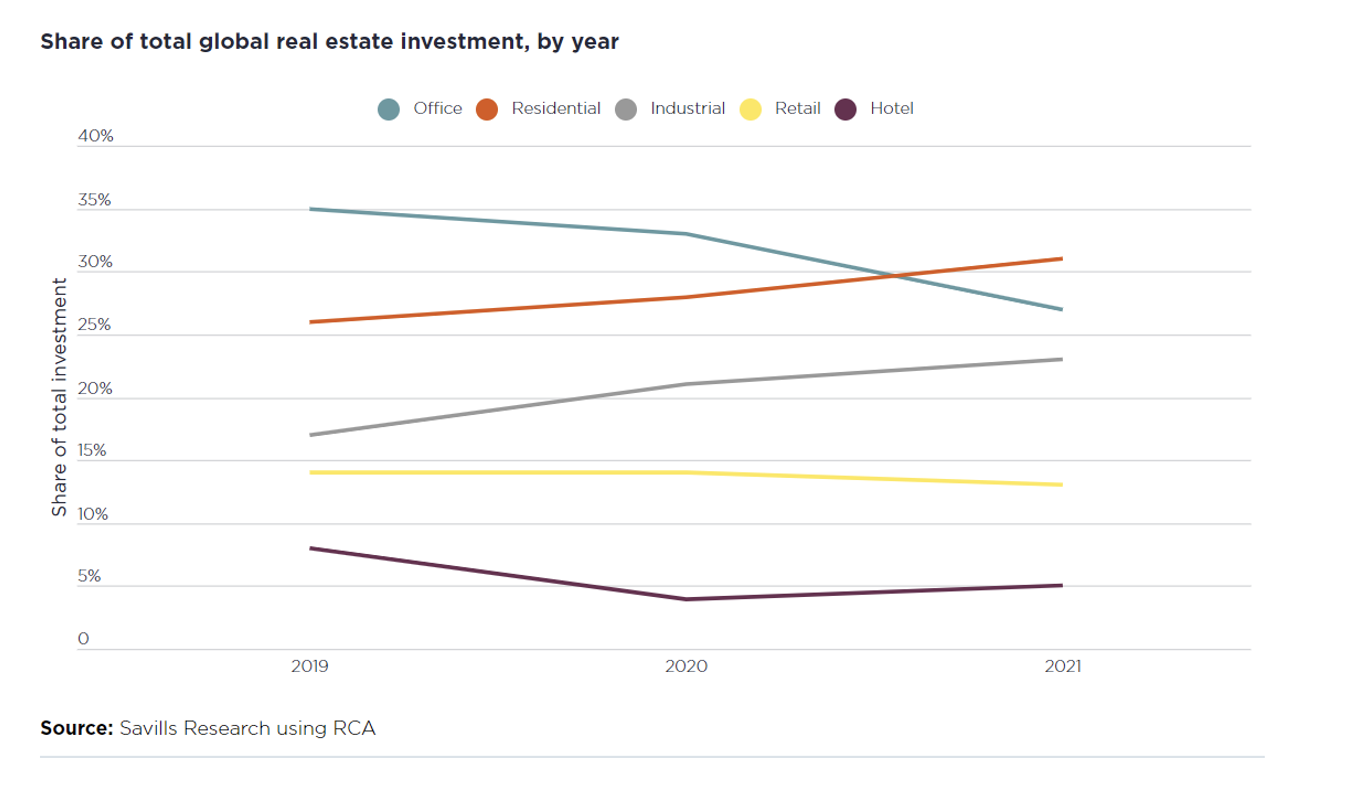

As the chart below reproduced from Savills shows, the past few years have seen a significant shift within real estate away from offices and towards residential and industrial usage.

This is unsurprising, given the large-scale adoption of so-called ‘hybrid’ working practices by many employers, whereby staff are no longer required to be in the office 5 days a week and have a certain amount of discretion in terms of when and where they complete their tasks.

This socio-economic trend suggests that residential rental markets closely connected to vibrant city centres will thrive in the years ahead, with cash-rich young professionals showing little inclination to leave cities even as their jobs are adapted to include some flexibility in terms of location.

Indeed, this sub-sector is just another example of an area of the real estate world where market-beating returns can be made by those able and willing to allocate their capital towards meeting this need early on, as the following case study will show.

High-end urban rental markets boom around the world

Axa Investment Management recently announced that it has acquired two rental residential buildings in the Tokyo district of Sugamo for $54 million, bringing the total spend by Axa on Japanese real estate in the past year to just over $3.3 billion. Axa bought the S-Fort Katahira in Sendai, Japan seen below just over a year ago underlining their commitment to the urban rental market in Japan and elsewhere.

Whilst there is, of course, nothing surprising in a global asset manager investing heavily into real estate in a developed market such as Japan, the scale, pace, and increasing frequency that such investments are now taking place at does point to something interesting.

When explaining their investment strategy and the motivation behind the recent acquisitions, Axa has argued the two properties are indicative of a pocket of highly profitable real estate investments that can be found in inner cities around the world today.

Areas characterised by good transport links, even if they are not directly adjacent to the major business districts, as well as good social and commercial infrastructure have strong track records of attracting young professionals and the discretionary spending power they represent. Both singles as well as DINKYs (double-income, no kids yet) flock to these areas and are often willing to pay a premium to rent there.

Real estate is the ultimate alternative asset

In an era when stock markets around the world are sliding or trading sideways, we expect the reliability of property as a long-term investment to lead to a new generation of investors putting a portion of their savings into this timeless asset class.

Given that it is now very much a mainstream approach to include so-called alternatives in a suitably diversified portfolio, we believe that real estate should take precedent over other more speculative assets, simply because it is so well suited to meeting the needs of many savers and investors through its potential for capital appreciation and income yield.

However, as further articles will discuss, whilst the world of alternatives certainly begins with real estate, it doesn’t necessarily end there. Just as Shojin’s proprietary technology allows the fractionalisation of property investments previously out of reach for all but the wealthiest individuals, the same technology can be applied to many other potentially market-beating assets as well.