How do you invest your funds to ensure they aren't compromised by higher rates of inflation?

Well, far from being any arcane investor secret, compound interest is simply a mathematical process that involves reinvesting earned interest alongside the principal investment. Reapplying this process for a sustained period of time has the potential to generate considerable returns, although, as with any investment, risks apply. But first, let’s return to basics. How do you earn interest? Whenever you lend money to an organisation, such as governments via gilts, companies via corporate bonds, banks via savings accounts, or peer-to-peer lending via an IFISA, you accumulate interest on top of your original loan.

Most people would have encountered this as a figure given as an Annual Percentage Rate (APR). For example, an APR of 10% means that after lending £1,000, you would receive £1,100 back at the end of the year, generating an earned interest of £100.

After receiving your £1,100, you could either:

- Reinvest the £1,000 and spend the £100 as earnings

- Reinvest the total £1,100

The chart below highlights this exponential power. The figures show the enormous potential for returns merely by reinvesting the original £1,000 alongside the interest earned each year. After 10 years, with an interest rate of 10%, you’ll have made an additional £1,594.

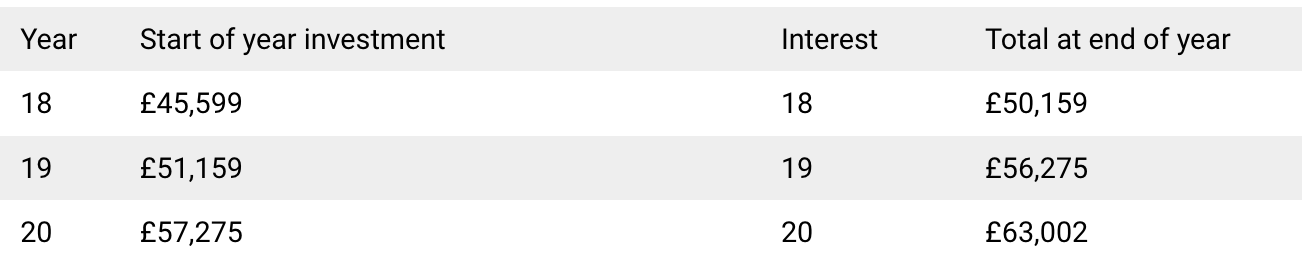

Furthermore, the greater the amount you can invest, the greater your potential for profit. Let’s take a look at what happens if you not only reinvest your earned interest but keep investing a further £1,000 each year

After 10 years and a total investment of £10,000, you will have made an additional £7,531.

Applying this for another 10 years and the interest truly starts to deliver incredible returns.

Over 20 years, you’ll have invested £20,00 but made a profit of £43,000.

Nothing special is going on here. It really is pure mathematics. But, as we have demonstrated, it does take time until large earnings truly start to accumulate, and investors will no doubt be aware that interest rates can vary and potential for returns is subject to risk.

However, the principles of compound investment can go a long way in helping investors maximise their returns over the long term and mitigate high inflation rates.

Tax efficiency and compound interest

With the powers of compound interest laid bare, it’s now time to turn to another weapon – tax efficiency – one which is complimentary to compound interest.

Tax efficiency may sound complicated, but the general idea is pretty simple: it’s about using the various investment vehicles and tools available to minimise the taxation on your returns and asset values. Let us take ISAs (Individual Saving Accounts) as an example, which can enable savings and investments to grow tax-free.

They are particularly tax-efficient because they protect money from taxes that would otherwise have to be paid on both the income the investment generates and on any increases in the value of the asset itself. Most valuably, they also enable investors to compound tax-free returns.

There are many different types of ISAs, each made with a different target audience in mind. These include the ISA, the Lifetime ISA, Stocks and Shares ISAs, and Innovative Finance ISAs. Every year you can save or invest up to £20,000 in an ISA, choosing to select one form or spread it across many.

Cash ISAs are quite similar to traditional savings accounts and can be opened at almost every major bank across the UK. By depositing money into one of these, investors stand to benefit from an annual interest rate which closely mirrors the base rate set by the Bank of England.

While these ISAs are generally very tax efficient, typically interest rates in regular ISAs stand at around 3-4%. Currently, with inflation standing around the double-digit mark, this can make it very challenging for them to deliver real-term growth.

As the name suggests, Stocks and Shares ISAs allow savers to hold conventional forms of investments such as stocks and shares within an ISA. With their eponymous equities often varying so often, such accounts are subject to greater volatility.

Meanwhile, the Lifetime ISA is a longer-term tax-free savings account. Savers can put in up to £4,000 every tax year toward buying a home or retirement planning and the government will provide a 25% bonus on top of the savings. While this is generous, this account does come with several restrictions on the use of the savings and when the cash can be withdrawn.

Finally, Innovative Finance ISAs (IFISAs) are accounts that allow ordinary savers and investors to lend and hold more dynamic forms of finance such as peer-to-peer loans and debt-based securities.

IFISAs are classed as investments, and in large part, this is because they have the ability to generate higher returns (which are not subject to tax) than traditional saving methods. For example, average returns on IFISAs have ranged between 7% – 9% over the past 5 years, compared to the typical 3-4% you would expect on the Cash ISA.

Within the property sector, IFISAs have unlocked the ability for ordinary investors to participate in high-grade property investment opportunities via lending platforms and reap the benefits of tax savings on any returns they receive. As with any investment opportunity, risk levels vary from project to project and investors should select their options based on their own financial goals, investment objectives, and risk appetite.

With inflation presenting a great hurdle to generating real term returns, the combined powers of compound investment and tax efficiency offer investors a powerful tool to navigate the economic landscape. While such tools often work best over the long term, investors with patience will stand to gain the potential rewards.

This article was originally written for Global Banking & Finance Review by Shojin CEO Jatin Ondhia.