After hovering close to 0% for years, inflation is on the rise. What does it mean for investors?

Respected financial journalist, Gabor Steingart recently included the fictitious image below in his widely read business roundup newsletter.

The juxtaposition of Christine Lagarde, current President of the European Central Bank, with the ridiculous ‘1,000’ denomination of the Euro certainly struck a chord with his predominantly German reader-base. Right now, fears of rising inflation far outstrip all other concerns at the heart of the Eurozone, and many German savers are increasingly concerned about the continuing impact of ultra-loose monetary policy on inflation, which in turn has the potential to prove so ruinous for their savings and investments.

Whilst it is true that long-term investors have a wide array of risks they need to monitor and be aware of, arguably the most pressing of these is the threat posed by rising inflation. This is because inflation erodes the real value of money, and therefore means your investments have to work even harder than before to provide you with an acceptable real return. Put simply, if prices are rising 3% each year, then your investments need to rise by at least 3% just to stay even. As such, recent data emerging from the Eurozone that inflation has hit a 10-year high of 3% and the expectation that the UK rate will soon follow suit has reignited the debate over how investors can best protect their investments against rising inflation.

Figure 1: Steingart’s Morning Briefing, ‘ECB hides inflation drivers’, Thursday, 2nd of September, 2021 (i)

The anticipated increase in UK inflation is all the more pressing because for several years inflation in the UK and other developed markets has generally been quite weak. In fact, it isn’t so long ago that economists were actually worrying that inflation was too low and could choke-off growth.

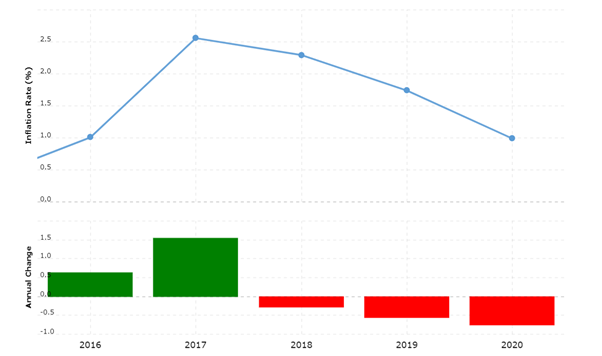

As can be seen in the Figure 2 below, 2020 saw UK inflation fluctuating around a meager 1%, and this was the culmination of a downwards trend begun back in 2017. Since then, increased economic activity due to the easing of Covid restrictions and the release of pent-up demand has seen inflation shoot up to 2.5% in June, 2021. Even more concerning is the Bank of England forecasting that inflation will reach 4% by the end of the year. Meanwhile, US inflation is at a near 30-year high, and thus a similar picture is now emerging across all developed markets. In short, it looks unavoidable that higher inflation needs to be something investors prepare for in the near future.

Figure 2: UK Inflation Rate, 2016-2020 (ii)

In this sort of inflationary context, careful consideration of the investment decisions you make is even more crucial than usual. Specifically, how you chose to allocate your resources between different asset classes can have a dramatic effect on the returns you see when inflation is on the rise.

How can real estate investments help you beat inflation? The key point is that there are significant variations in performance between different assets against a background of high or rising inflation.

Essentially, bonds and all other investments producing fixed income struggle greatly during periods of high inflation, as the real yield on such holdings often falls to zero or negative territory. This is because the fixed coupon that the bond pays doesn’t adjust for higher prices, and so the real (i.e. inflation adjusted) value of the cash flow that the bond allows you to access falls. The same can be said for cash ISAs and other savings accounts, with data from the Bank of England showing that the average rate on cash ISAs between March 2020 and April 2021 was a paltry 0.46%. UK savers, just like their German counterparts, are worrying about how to preserve their purchasing power in an environment where inflation runs well ahead of the rates available on traditional savings and investment products.

This has led many private investors to hunt for ways they can boost the return they get on their hard-earned savings, whilst simultaneously keeping an eye on inflation and ways they can hedge against further price increases. This is where real estate investments come in, because real estate is an asset class that can ‘out-run’ inflation in several ways.

Firstly, inflation should carry property prices higher, meaning there is strong potential to increase the value of any capital invested in real estate over time. As the received wisdom runs, ‘bricks and mortar’ are physical assets which should hold-up well when the value of money falls based on the essential nature of housing. It’s also true that some of the factors that fed into higher inflation can also contribute to an accelerating increase in property prices, for example: easy access to credit, consumers’ generally being optimistic about their future incomes, or a tight labour market leading to rising wages. So, capital appreciation is a distinct possibility from real estate investment in an inflationary context.

Secondly, inflation means rental prices tend to increase as well. This increase in the income generated by property investment is a major advantage of this approach to hedging against inflation in comparison to holding gold, another traditional inflation hedge. Whilst gold could offer similar benefits to owning real estate in terms of increasing in value during times of high inflation, gold doesn’t yield any kind of passive income. Whilst there is an interesting debate to be had over the relative merits of property versus gold in this light, the dual opportunity for capital appreciation plus passive income, both of which should increase faster than the rate of inflation is what makes real estate investment so attractive.

With the Bank of England base rate currently just 0.1%, it is unlikely to say the least that any savings account can now or will soon be able to offer an inflation-beating return. As such, the choice faced by those with savings and a desire to see them grow over time is comparatively simple. You can either:

- 1. Park your cash in a savings account and be content that your money is extremely secure, in the sense that insolvency of the bank when you come to withdraw your savings is incredibly unlikely, but accept the real value of your savings will decline, potentially quite dramatically;

- 2. Invest in equities and hope that they will manage to out-run inflation;

- 3. Explore alternative investment opportunities such as real estate.

For most individual investors, it is much more likely to be a case of combining all three approaches in relation to their specific goals and the timeframe over which they are investing, but the value of adding some real estate to your portfolio can hardly be overstated.

This where Shojin comes in. Shojin is an FCA-regulated property investment company that strives to democratize the real estate investment market by expanding the access that ordinary investors have to this highly lucrative sector. Shojin’s innovative combination of technology, real estate knowledge, and investment expertise means they have been able to significantly lower the barriers to entry for individuals across the globe looking to access institutional-grade real estate investment opportunities in the UK.

At the heart of Shojin’s vision is their unique online platform, which is designed to make property investment accessible, simple, and affordable. The key concept powering Shojin’s approach is that by enabling fractional investments to be made in real estate developments, a much wide range of private investors can take part that is traditionally the case. By specializing in the profitable residential, PRS (private rented sector), senior, and student accommodation sectors, Shojin are able to ensure that all investment opportunities are thoroughly vetted by leveraging their substantial previous experience whilst full due diligence is performed. This means the real estate projects Shojin funds are only the most promising and those for which a strong case can be made based on fundamental analysis.

Although Shojin tend to reject around 95% of projects which don’t meet their stringent criteria, for those schemes that do pass the test Shojin then negotiates directly with the developer before co-investing the junior funding element with its client base, with typical expected returns of between 15% and 25%. Due to Shojin’s confidence in the success of its investments, the company does not take large upfront fees, but rather invests its own capital into every project, puts itself in a first loss position, and shares profits at the completion of the project. This alignment of interests is crucial for trust; not only will Shojin lose its investment first if a project fails, it only makes money when its investors do.

We have already seen how real estate investments can provide an excellent hedge against inflation by offering the combination of capital appreciation and passive income. With the current monetary regime likely to remain in place for the foreseeable future, the search for inflation-beating returns is leading more and more private investors to explore their options across the real estate investment landscape. Through Shojin, investors can access institutional-grade development projects for as little as £5,000, with the company ultimately aiming to incrementally lower this threshold to under £100 in the future as this exciting new market continues to expand.

References

References