Invest - Products - Equity

Share in the profits with an equity investment

Development equity is typically structured as a loan, allowing investors to share in the profits of a project.

What is development equity?

Earn returns similar to those of a property developer

Development equity is used by property developers who need additional non-bank financing. These products are typically structured as loans which and sit below the senior bank debt, and any other debt, in the funding structure. When the project completes, investors receive a share of the profits.

How does development equity work?

Add Equity for full funding

To mitigate risk, a bank or senior lender will rarely lend 100% of total development costs to a developer. It is typically capped at the 80% mark, requiring the developer to contribute the remaining 20%.

The Shojin model lets developers cover this 20% through a combination of their own funds and money raised from investors. By filling the equity gap, investors are granted a variable profit share at the end of the project.

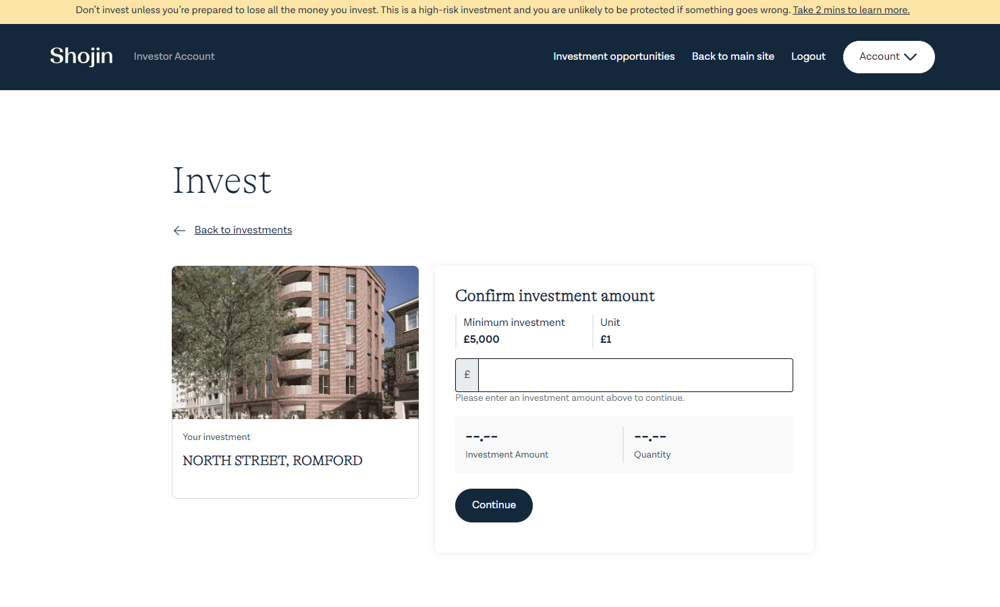

Funds are paid back at the end of projects, usually 12 to 36 months from drawdown.

Why choose a Shojin equity investment?

Diversify your portfolio with profit sharing investments

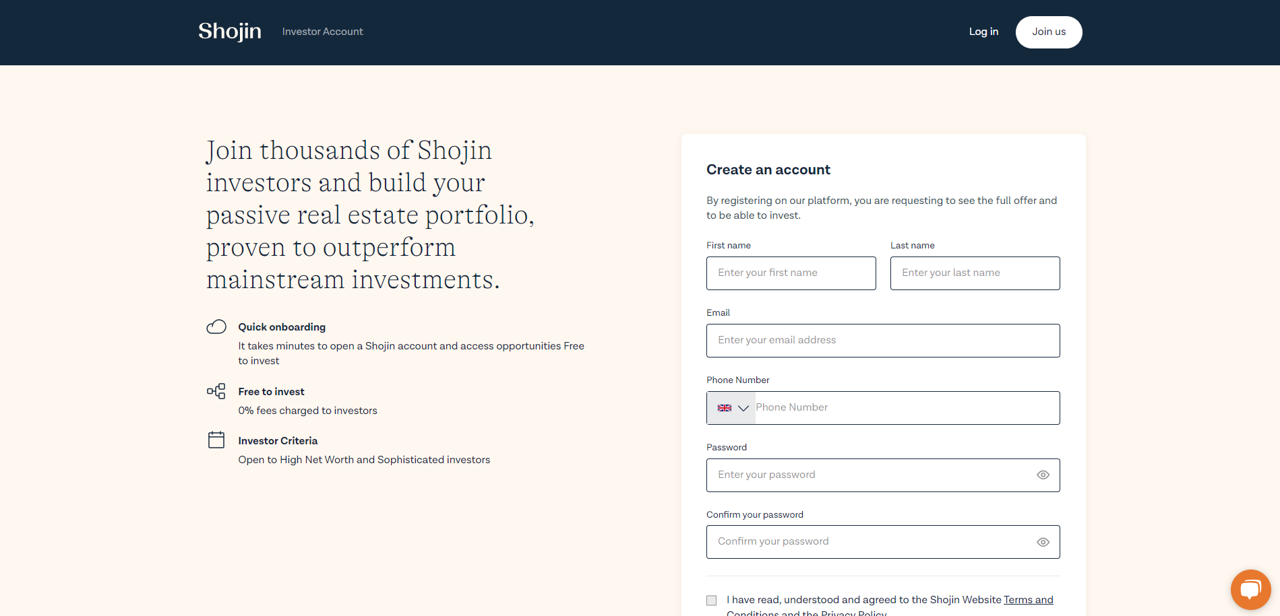

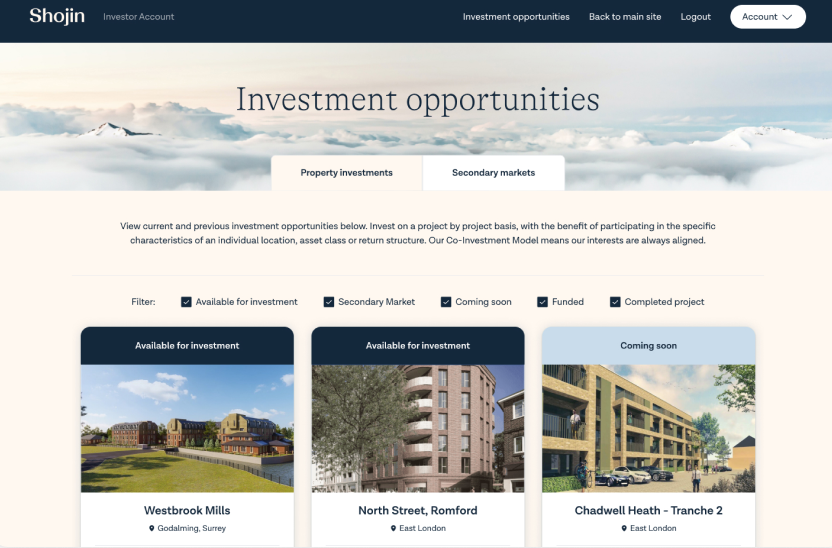

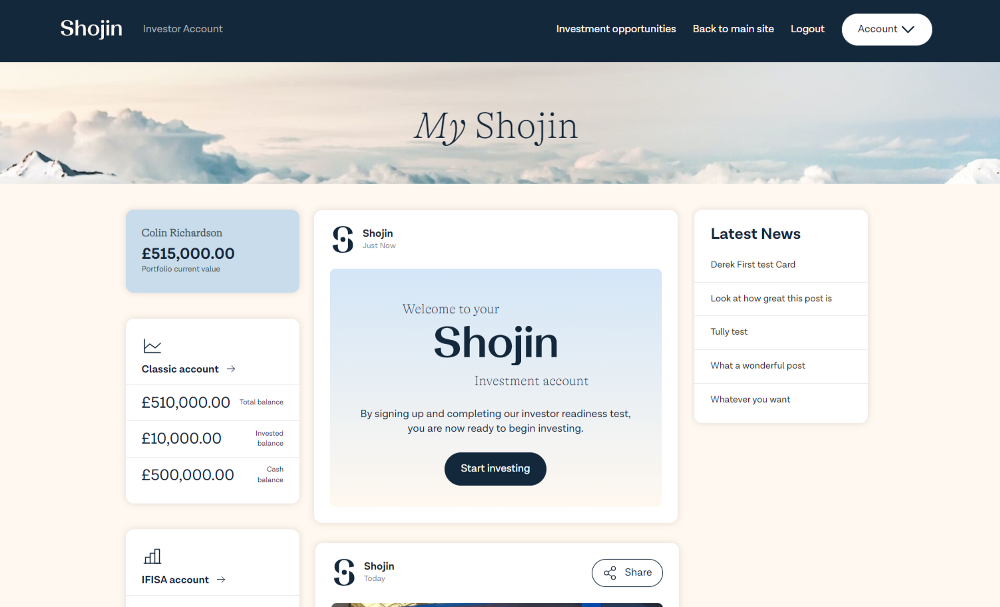

How to get started

Start investing in five simple steps

Understanding the risks

Choosing the project that's right for you

Even within equity products, each project is different. We carry out extensive due diligence on each area and share this information through the project Investment Memorandum (IM). Choose the opportunity that meets your investment objectives in terms of profile and risk.

Project phase

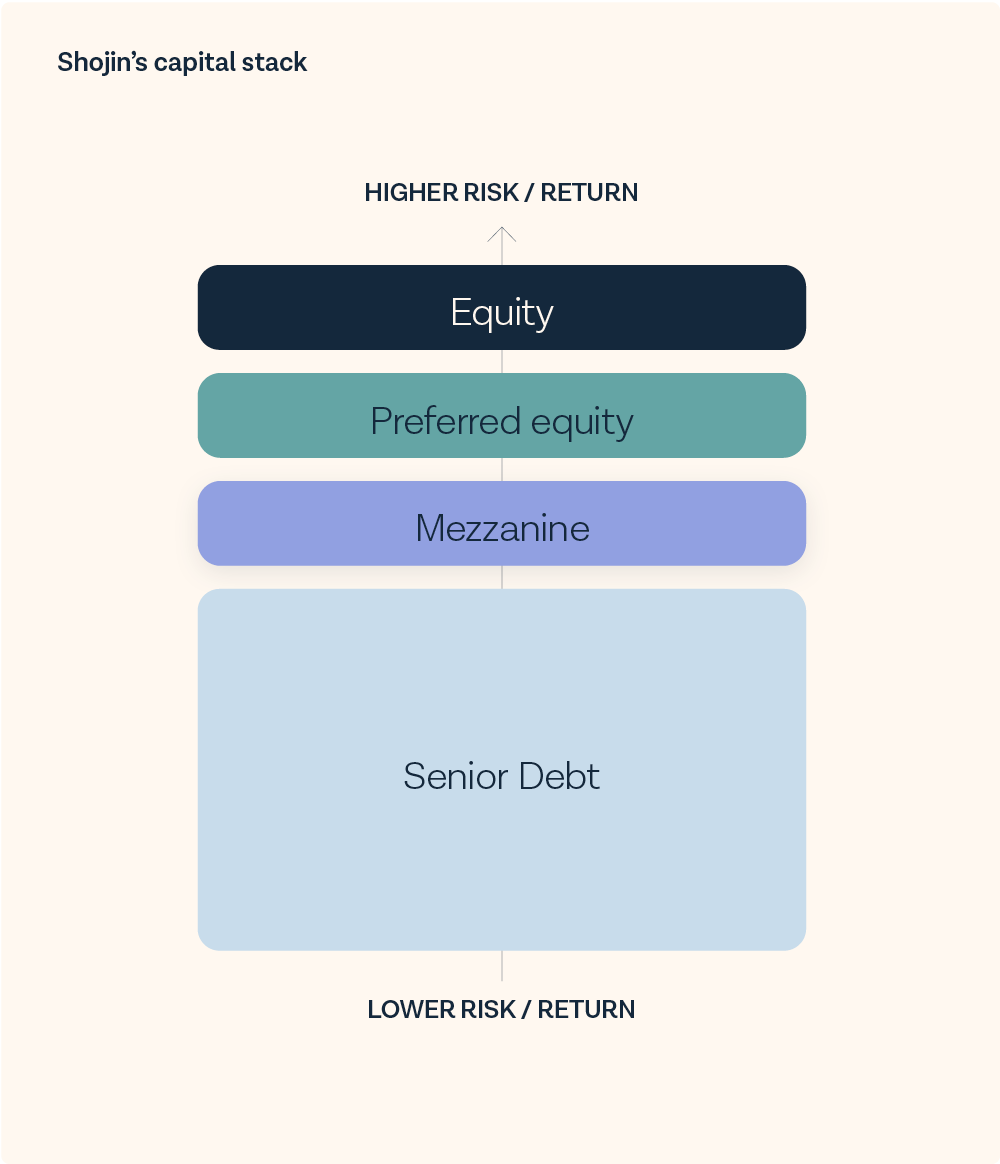

The capital stack represents the layers of funding and the order of repayment. First is the senior debt, then mezzanine, followed by preferred equity and finally equity.

-

Value above and belowThe value that sits below the investor is important because this is the amount that needs to get generated and repaid before the investor. The value above is equally crucial because it represents the cushion that investors have before their returns start getting affected.

-

Key ratiosThe position in the capital stack is indicated by the Loan-to-value (LTV), Loan-to-Gross-Development-Value (LTGDV) and Loan-to-cost (LTC), the higher the ratios the higher the risks.

-

Seniority mattersThe position in the stack becomes relevant if a project is not performing and fails to pay out all the funds, from the bottom of the stack upwards. The higher you rank, the more likely your capital and interest will be affected.

Assessing the suitability of a development in a given location is critical to the success of the project. Physical, economic and cultural factors interact with the development's design and purpose, affecting its viability and attractiveness to potential buyers or tenants.

-

Demographics of potential buyersThe demand for a development is driven by the lifestyle preferences, practical needs, incomes and aspirations of potential residents. Whether located in an urban or rural locale, the development must cater for the requirements of buyers in that area.

-

AmenitiesThe availability, quality and proximity of infrastructure, including transportation networks, schools, shopping facilities and employment opportunities play a vital role in determining a development's desirability.

-

Physical characteristicsThe geography of a location, such as terrain, climate, and proximity to natural resources, can impact project feasibility and execution. Extreme weather conditions, geological instability, or environmental regulations can lead to delays, increased costs, or even project abandonment.

To protect investors from individual project risks, protection mechanisms are put in place to secure investors from scenarios that put their investments at risk. They incentivise the developer to repay funds for investors to exit the projects.

-

Charges held with land registryA charge is the means by which lenders enforce their rights to property. A first charge entitles the lender repossess and sell the asset to recoup funds first, followed by a second charge which is paid out after the senior lender in priority over the developer’s equity.

-

Personal guaranteesBorrowers may be asked to provide personal guarantees to make them legally liable to repay the loan. Whilst this is a legitimate way to add further security, it is also a way to keep the borrower focussed on repaying the loan especially if the scheme runs into trouble.

-

Additional securityThis may include cost overrun guarantees, debentures or cross-collateralisation across other assets the developer owns, which in the event of a default, can be repossessed and sold.

The complexity of a construction project impacts the level of risk for investors. This is driven by a combination of factors including intricacy of design, engineering requirements, execution, and management required to successfully complete the project. Fixed-cost contracts and professional advice from surveyors is typically required to manage these risks.

-

Scale of the buildLarger intricate projects, such as high-rise buildings or sprawling housing developments, tend to be more complex due to the increased scope, logistics, and coordination involved. They typically require structural elements that demand careful engineering and construction expertise.

-

Nature of the siteChallenging site conditions, such as irregular terrain, poor soil quality, or tight spaces with reduced access, can complicate construction logistics and impact foundation and site preparation.

-

Architectural design and permissionsUnique, innovative, or intricate architectural designs can lead to complexity in construction, requiring specialised skills, materials, and precision. Likewise, planning conditions dictate specific delivery requirements and adherence to compliance.

Project phase

The stage at which investors come into the project determines the level of risk. Generally, the earlier the investors come into a development project, the more risk they take on as there are more milestones for the developer to hit. There are several categories of phase that should be considered.

-

Planning statusA development project with no planning permission is ultimately a speculative play as it may take longer than expected, or in some cases never come through at all. Whilst if full consented planning or permitted development rights (office to residential conversions) are in place, you know what is being built and the associated value of this.

-

Type of developmentFull construction, conversion or renovation projects all have different levels of risk. If the structure of the building is already existent there are no associated costs uncertainties. Conversion and renovations are simpler to deliver which reduce time and cost risk.

-

Status of developmentDevelopments take time; there are many items which influence costs and timelines. Coming in at an earlier stage means that tendering, site ramp-up and preliminaries are required which present cost uncertainty. The closer you are to construction completion, costs are determined and it become more about realising the value.

In order to get repaid and exit a project the value needs to get realised to release cash. This can take the form of the sale of the units or the refinancing of the block in its entirety.

-

Selling individual unitsSelling units is dependent on demand, attractiveness and local competition from similar units in the area. Sales and marketing strategies need to be executed to encourage pre-sales ahead of construction completion and bulk sales to reduce risk.

-

Refinancing to release fundsAnother option available to developers to repay investors is to refinance the entire finished block. A completed development commands a higher value than previously, against which a loan can be raised to repay investors. If the value is sufficient, this is likely a quicker solution than individual sales.

-

Occupancy for asset investmentsFor income-generating assets such as student accommodation blocks that depend on occupants, pre-secure locked in tenancies reduce risks. Likewise for commercial assets, established tenants with strong covenants provide stable cashflows which reduce the risks.

A developer’s track record dictates their suitability to take on and deliver a given project. Their team, their financial credentials, capacity and trustworthiness all impact risk.

-

Previous developmentsPast performance is used to assess their ability to handle potential challenges and mitigate risks. Similarly, their reputation can influence the market's perception of the quality and value to attract buyers.

-

Contractor and supplier relationsEstablished developers often have built relationships and with reliable contractors and suppliers, and have a strong professional team working for them, reducing the risk of delays or disruptions due to poor workmanship, material shortages or technical failures. Additionally, they need to have the capability to deal with situations where subcontractors and suppliers underperform or go out of business.

-

Financial standingA developer’s credit history is an indicator of how their previous developments have performed. Their asset and liabilities statements indicate previous success and ability to cashflow construction between drawdowns, provide personal guarantees and cross collateralise across their other assets to reduce the risks for investors.

Time plays a critical role in property development and has a significant impact on the associated risks. It is usually time, rather than cost, that affects a project’s success and profitability.

-

Market fluctuationsThe longer a project takes to complete, the more susceptible it is to shifts in market conditions and inflation. Changes in housing demand, housing prices, material and labour costs and economic factors can affect the project's viability and potential returns.

-

Financing costsExtended project timelines lead to increased financing costs in the form of interest payments. Whilst this might not impact a senior lender’s position, this does reduce the cushion for those further down the repayment chain. Equally, changes in interest rates overtime can increase overall project costs.

-

External factorsOve over a prolonged development period, geopolitical events, economic recessions, and unforeseen global disruptions can impact a project's risk profile.

FAQs

The frequently asked questions and key terminology for investing in mezzanine loans.

Take your investments

to the next level.

Sign up for access to our expertly selected investment opportunities. Build your diversified property portfolio today.